The Definitive Guide for What Does Comprehensive Auto Insurance Cover

I pay a $15 Co-Pay each time. All of my x-rays are: No Charge! I picked an In-Network Humana Dental Provider close to my house. I receive a 25% discount if I go to an expert.' The most significant complaints are to do with bad client service through telephone, and call center personnel not effectively comprehending the various dental plans on deal.

The PPO and DHMO alternatives are limited to just two plans, however preventative care is covered. MetLife Dental Insurance coverage uses two type of strategies: a Dental PPO Plan and a Dental HMO/Managed Care Plan. The latter is available in California, Florida, New Jersey, New York City and Texas. With these strategies, you do not have deductibles or claims forms to handle, but you must select an in-network dental expert when registering.

Included orthodontics make it ideal for households who have kids in requirement of braces, while low copays assist it appeal to anyone wanting to https://www.businesswire.com/news/home/20190723005692/en/Wesley-Financial-Group-Sees-Increase-Timeshare-Cancellation make a decent conserving on dental care. With approximately 45% to be saved, this is one of the much better options out there, spanning over 400 treatments and a network of 90,000 dental practitioners.

internet. You'll get numerous quotes to compare oral strategies that better fit your needs and http://www.wesleygrouptimeshare.com/wesley-financial-chuck-mcdowell-help/ budget.VIEW OFFER ON HealthInsurance. netRated at Ratings by means of Like a lot of the huge oral medical insurance companies, MetLife has is ranked A+ at the Better Business Bureau, and has a 4. 4 star ranking at Consumers Supporter.

Some praised the service received, while others were irritated with long haul times on phones, and lack of payments where cover was supposedly not fairly dealt out. Favorable evaluations on ConsumerAffairs stated that, 'There was never an issue with claims processing,' which the policy was, 'an include on to my existing health insurance coverage through my employer.

The supplier holds an A+ rating with the Better Company Bureau, plus premium scores for financial strength and stability. There are a large range of oral plans on deal here, with a simple search function available by means of the website so that you can discover a dental practitioner within the 100,000+ specialists noted as in-network.

Rumored Buzz on How To Cancel State Farm Insurance

Guardian Direct Dental Insurance strategy costs are reasonable, with strategies starting for as low as $16 each month. You can access up to 35% discounts on some treatments, with affordable copay alternatives for bigger dental treatments. The Guardian Dental website provides three detailed mini Q&A s to help you find the right dental coverage.

Compare Dental Insurance Coverage QuotesCompare Guardian Direct Dental versus other providers utilizing HealthInsurance. web. You'll get multiple quotes to compare dental plans that better fit your requirements and budget.VIEW DEAL ON HealthInsurance. netRanked at Ratings at Depending on which website you search, Guardian Direct Dental Insurance coverage evaluations are also extremely combined, which is intriguing.

8 score out of 5. One recent review mentioned that, 'I'm so happy that my employer selected Guardian Dental as our provider - they have covered a lot and even have a rollover strategy that has actually come really helpful when I maxed out my yearly advantage.' Other consumers were dissatisfied with the customer support, complaining that staff need to be more clear when discussing advantages, caps and reimbursements.( Image credit: Delta Dental) Wide plan varietyFree x-raysNot all procedures are approvedAvailability differs by stateDelta Dental is one of the largest dental insurers in America, covering all 50 states, and has 6 various plan alternatives.

There are over 340,000 dental professionals in the Delta Dental PPO and Dental Dental Premier Plans, so you'll hardly be stuck for option. Similar to all of the best dental insurance service providers, strategies and the precise levels of protection differs by state. Rates varies on where you live too. Preventive care such as cleansings and X-rays are covered at 100%, and all basic and more extensive oral treatments and services such as crowns, root canals and oral implants are covered at approximately 50%.

There is a state by state variation on availability, however with over 78 million people utilizing Delta Dental Insurance, it's plainly doing something right. Cover not just works for individuals but likewise reaches households and can be accessed by means of your employer too. Compare Dental Insurance Coverage QuotesCompare Delta Dental against other companies utilizing HealthInsurance.

You'll get multiple quotes to compare dental plans that better fit your requirements and budget.VIEW DEAL ON HealthInsurance. netRanked at Ratings at According to Finest Company, Delta Dental consumers are 'Generally pleased with the protection and service they get from Delta Dental. Reviewers are likewise happy with its large network of dental companies.' That said, some customers experienced troubles when getting oral procedures authorized, leading to frustrating hold-ups - how to check if your health insurance is active online.

What Does How To Read Blue Cross Blue Shield Insurance Card Do?

Delta Dental offers a variety of strategies, and the level of customer experience differs across them. Compare Dental Insurance QuotesDental insurance can be pricey, depending on where you live and the plan you select, so begin your search today at HealthInsurance (what is the difference between term and whole life insurance). net and get numerous quotes to compare dental insurance that fits your needs.VIEW OFFER ON HealthInsurance.

When it comes to picking an oral plan, make a list of your primary oral care requirements and balance those versus a list of 'nice to have' advantages. Consider whether exceptional customer care and a large network of dentists are essential to you, or whether you just require regular preventive care and low regular monthly expenses.

In our experience, we have actually discovered that the bulk of dental practitioners recognize with what requirement and complete protection dental insurance encompasses and can for that reason talk you through this before any treatment is provided. Does the dental insurance coverage service provider you're considering deal a good choice of strategies in your state? What are the out-of-pocket costs? Are they budget-friendly? These can quickly build up, so ensure you can get the care you need without having to pay through the nose once you surpass any annual optimum limits.

You're paying for this, so just go with an oral insurance coverage supplier that has an excellent variety of dental professionals near to where you live. The reality is, the more affordable dental insurance plans frequently have more exclusions (ie, what they do not cover), but is this cost-efficient for you in the long run? Well, if your teeth and gums remain in health, and so you just require fundamental check-ups and cleansings, you might be fine with one a more affordable plan.

If you have a pushing need for dental care, we 'd recommend avoiding oral insurance coverage plans with waiting periods, or else you may be facing a waiting duration of approximately one year prior to coverage starts - and you can get the treatment you need. Oral insurance coverage is different to oral discount strategies, as the latter only offers minimized rates on services for dentists in a specific network.

These include basic, preventive care, through crows and root canals. You pay a monthly insurance premium, and you may even have to pay a yearly or life time deductible, plus any copayments, when you visit a dentist for treatment. While the Affordable Care Act avoided any limits on health care protection from being used in a given year, even the best oral insurance coverage often comes with annual limitations as low as $750 per person.

The Best Guide To What Does Enterprise Car Rental Insurance Cover

I pay a $15 Co-Pay each time. All of my x-rays are: No Charge! I chose an In-Network Humana Dental Service provider near to my house. I get a 25% discount if I go to a professional.' The greatest problems are to do with poor consumer service by means of telephone, and call center staff not sufficiently comprehending the various dental intend on deal.

The PPO and DHMO alternatives are restricted to just 2 strategies, but preventative care is covered. MetLife Dental Insurance coverage provides 2 type of strategies: a Dental PPO Strategy and a Dental HMO/Managed Care Strategy. The latter is offered in California, Florida, New Jersey, New York City and Texas. With these strategies, you do not have deductibles or claims types to deal with, however you should choose an in-network dental professional when registering.

Included orthodontics make it ideal for families who have kids in requirement of braces, while low copays help it appeal to anybody intending to make a good saving on oral care. With up to 45% to https://www.businesswire.com/news/home/20190723005692/en/Wesley-Financial-Group-Sees-Increase-Timeshare-Cancellation be saved, this is one of the better alternatives out there, covering over 400 treatments and a network of 90,000 dental practitioners.

net. You'll get multiple quotes to compare oral plans that much better fit your needs and budget.VIEW DEAL ON HealthInsurance. netRanked at Ratings by means of Like a lot of the big oral medical insurance companies, MetLife has is ranked A+ at the Better Service Bureau, and has a 4. 4 star rating at Consumers Advocate.

Some praised the service received, while others were irritated with long haul times on phones, and lack of payments where cover was supposedly not fairly dealt out. Favorable evaluations on ConsumerAffairs mentioned that, 'There was never a problem with claims processing,' and that the policy was, 'an add on to my existing health insurance through my company.

The provider holds an A+ ranking with the Better http://www.wesleygrouptimeshare.com/wesley-financial-chuck-mcdowell-help/ Organization Bureau, plus premium scores for financial strength and stability. There are a broad variety of oral strategies on offer here, with a simple search function available through the site so that you can discover a dental expert within the 100,000+ experts noted as in-network.

Getting My Why Is My Insurance So High To Work

Guardian Direct Dental Insurance coverage strategy costs are reasonable, with strategies beginning for as low as $16 monthly. You can access up to 35% discount rates on some treatments, with affordable copay alternatives for larger oral treatments. The Guardian Dental website uses three detailed mini Q&A s to assist you discover the ideal dental coverage.

Compare Dental Insurance QuotesCompare Guardian Direct Dental versus other service providers utilizing HealthInsurance. internet. You'll get multiple quotes to compare dental strategies that much better fit your requirements and budget.VIEW OFFER ON HealthInsurance. netRated at Ratings at Depending on which site you search, Guardian Direct Dental Insurance evaluations are also wildly combined, which is fascinating.

8 rating out of 5. One recent review stated that, 'I'm so happy that my employer chose Guardian Dental as our supplier - they have actually covered a lot and even have a rollover strategy that has actually come very useful when I maxed out my yearly benefit.' Other clients were dissatisfied with the client service, complaining that personnel need to be more clear when describing benefits, caps and reimbursements.( Image credit: Delta Dental) Wide plan varietyFree x-raysNot all procedures are approvedAvailability varies by stateDelta Dental is one of the biggest dental insurance providers in America, covering all 50 states, and has six different plan options.

There are over 340,000 dentists in the Delta Dental PPO and Dental Dental Premier Plans, so you'll barely be stuck for choice. Just like all of the very best oral insurance coverage suppliers, strategies and the specific levels of protection varies by state. Pricing varies on where you live too. Preventive care such as cleansings and X-rays are covered at 100%, and all standard and more extensive dental treatments and services such as crowns, root canals and dental implants are covered at approximately 50%.

There is a state by state variation on schedule, however with over 78 million people using Delta Dental Insurance coverage, it's clearly doing something right. Cover not just works for individuals but also extends to families and can be accessed by means of your company too. Compare Dental Insurance QuotesCompare Delta Dental against other service providers using HealthInsurance.

You'll get numerous quotes to compare dental strategies that better suit your needs and budget.VIEW DEAL ON HealthInsurance. netRanked at Scores at According to Finest Company, Delta Dental consumers are 'Usually pleased with the coverage and service they receive from Delta Dental. Reviewers are also happy with its big network of dental companies.' That said, some customers experienced troubles when getting oral treatments authorized, resulting in aggravating delays - what is a premium in insurance.

What Does How To Become An Insurance Broker Do?

Delta Dental provides a variety of strategies, and the level of customer experience differs across them. Compare Dental Insurance coverage QuotesDental insurance can be costly, depending upon where you live and the plan you select, so begin your search today at HealthInsurance (what is the difference between term and whole life insurance). net and get numerous quotes to compare oral insurance that fits your needs.VIEW DEAL ON HealthInsurance.

When it concerns choosing a dental strategy, make a list of your primary oral care needs and balance those versus a list of 'nice to have' benefits. Think of whether exceptional client service and a big network of dental professionals are essential to you, or whether you just need regular preventive care and low month-to-month costs.

In our experience, we've found that the majority of dental experts recognize with what requirement and full coverage oral insurance coverage extends to and can therefore talk you through this before any treatment is used. Does the dental insurance coverage company you're thinking about deal a good selection of plans in your state? What are the out-of-pocket expenses? Are they economical? These can rapidly accumulate, so make sure you can get the care you require without having to pay through the nose as soon as you surpass any annual maximum limitations.

You're spending for this, so only opt for an oral insurance provider that has an excellent number of dental professionals close to where you live. The reality is, the cheaper dental insurance strategies frequently have more exemptions (ie, what they do not cover), but is this cost-efficient for you in the long run? Well, if your teeth and gums remain in health, therefore you only require basic check-ups and cleansings, you might be great with one a less expensive plan.

If you have a pressing need for oral care, we 'd suggest preventing dental insurance coverage strategies with waiting durations, or else you may be dealing with a waiting period of approximately one year prior to protection begins - and you can get the treatment you require. Oral insurance coverage is various to dental discount rate plans, as the latter only offers reduced pricing on services for dental practitioners in a particular network.

These include fundamental, preventive care, through crows and root canals. You pay a regular monthly insurance premium, and you may even have to pay an annual or life time deductible, plus any copayments, when you check out a dental practitioner for treatment. While the Affordable Care Act avoided any limits on health care coverage from being used in a given year, even the best oral insurance frequently includes yearly limitations as low as $750 per individual.

What Does How To Become An Insurance Adjuster Mean?

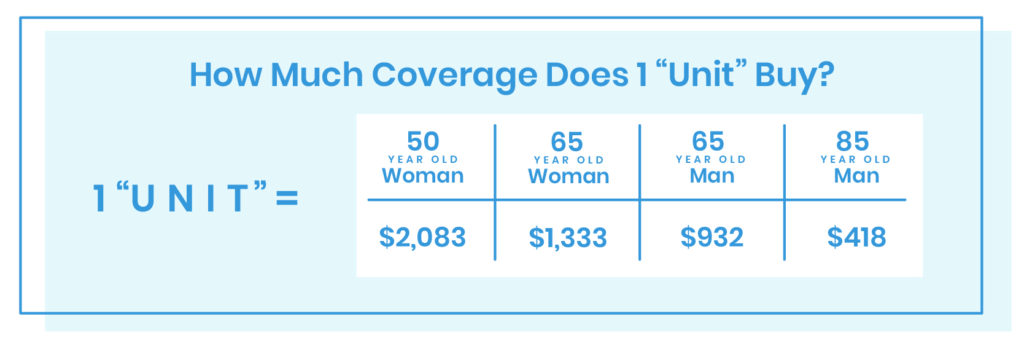

If you're going to invest the cash on long-lasting care insurance, make sure your benefits will be sufficientand offered to support you. Because long-term expenses will likely continue their upward climb, you may think about adding inflation protection. Likewise, select an Discover more here insurance provider with a strong performance history and solid financial health.

Your long-lasting care insurance should fit your personal circumstance (how does term life insurance work). A person might require a various level of protection than a couple since a single individual has to consider the long-term care needs of only https://www.springhopeenterprise.com/classifieds/wesley+financial+group+llc+timeshare+cancellation+experts+over+50000000+in+timeshare+debt+and+fees+cancelled+in,212189 one person. For couples, think about the effect on your partner's monetary scenario if you have a prolonged long-term care scenario - how much renters insurance do i need.

Things about How To Become An Insurance Adjuster

If you're going to spend the money on long-term care insurance, ensure your advantages will be sufficientand offered to support you. Since long-term expenses Discover more here will likely https://www.springhopeenterprise.com/classifieds/wesley+financial+group+llc+timeshare+cancellation+experts+over+50000000+in+timeshare+debt+and+fees+cancelled+in,212189 continue their upward climb, you might consider adding inflation defense. Also, choose an insurance business with a strong performance history and solid financial health.

Your long-term care insurance should fit your personal situation (how much is car insurance a month). An individual might require a various level of coverage than a couple because a bachelor needs to think about the long-term care requirements of just one individual. For couples, think about the effect on your spouse's financial situation if you have an extended long-term care circumstance - how much does homeowners insurance cost.

10 Simple Techniques For How Much Do Life Insurance Agents Make

Table of ContentsA Biased View of What Is Whole Life Insurance PolicyThe Ultimate Guide To How To Buy Life InsuranceRumored Buzz on How To Find Out If Life Insurance Policy ExistsThe 30-Second Trick For Who Can Change The Beneficiary On A Life Insurance PolicyWhich Of The Following Best Describes Term Life Insurance - QuestionsOur What Is The Purpose Of A Disclosure Statement In Life Insurance Policies Statements

This investigation and resulting examination is termed underwriting. Health and way of life concerns are asked, with particular responses perhaps meriting more examination (what is a whole life insurance policy). Specific factors that may be considered by underwriters include: Personal medical history; Family medical history; Driving record; Height and weight matrix, otherwise referred to as BMI (Body Mass Index). Based on the above and additional factors, candidates will be placed into one of numerous classes of health ratings which will identify the premium paid in exchange for insurance coverage at that specific carrier.

As part of the application, the insurance company often requires the candidate's permission to obtain information from their doctors. Automated Life Underwriting is a technology solution which is developed to perform all or some of the screening functions generally completed by underwriters, and therefore seeks to decrease the work effort, time and/or information necessary to underwrite a life insurance coverage application.

The mortality of underwritten individuals increases much more quickly than the basic population. At the end of 10 years, the death of that 25-year-old, non-smoking male is 0.66/ 1000/year. Consequently, in a group of one thousand 25-year-old males with a $100,000 policy, all of typical health, a life insurance coverage business would have to collect around $50 a year from each participant to cover the reasonably few anticipated claims.

What Is Direct Term Life Insurance Things To Know Before You Buy

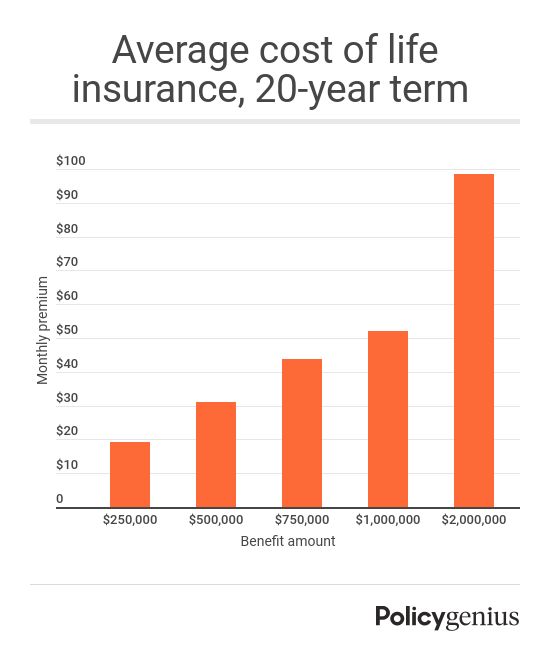

A 10-year policy for a 25-year-old non-smoking male with preferred case history may get offers as low as $90 each year for a $100,000 policy in the competitive US life insurance market. The majority of the revenue received by insurance business includes premiums, but earnings from investing the premiums forms an important source of revenue for a lot of life insurance coverage business.

In the United States, life insurance coverage business are never lawfully required to offer coverage to everybody, with the exception of Civil liberty Act compliance requirements. Insurance coverage companies alone identify insurability, and some individuals are considered uninsurable. The policy can be declined or ranked (increasing the premium amount to compensate for the greater risk), and the amount of the premium will be proportional to the stated value of the policy.

These classifications are preferred best, chosen, requirement, and tobacco. Preferred finest is booked only for the healthiest individuals in the general population. This might indicate, that the proposed insured has no adverse case history, is not under medication, and has no family history of early-onset cancer, diabetes, or other conditions.

Some Ideas on What Is Term Life Insurance You Should Know

The majority of people remain in the basic classification. People in the tobacco category usually have to pay higher premiums due to the greater mortality. Current US https://angelofnaz529.skyrock.com/3337223550-About-What-Is-A-Corridor-In-Relation-To-A-Universal-Life-Insurance.html mortality tables anticipate that approximately 0.35 in 1,000 non-smoking males aged 25 will pass away throughout the first year of a policy. Death around doubles for every additional ten years of age, so the death rate in the very first year for non-smoking men is about 2.5 in 1,000 people at age 65.

Upon the insured's death, the insurance company needs acceptable evidence of death before it pays the claim. If the insured's death is suspicious and the policy amount is large, the insurer may examine the scenarios surrounding the death before deciding whether it has a responsibility to pay the claim. Payment from the policy might be as a lump amount or as an annuity, which is paid in regular installations for either a given period or for the beneficiary's life time.

In basic, in jurisdictions where both terms are utilized, "insurance coverage" describes offering protection for an event that may occur (fire, theft, flood, and so on), while "assurance" is the arrangement of coverage for an event that is particular to happen. In the United States, both kinds of coverage are called "insurance coverage" for factors of simplicity in business offering both items. [] By some definitions, "insurance" is any protection that determines benefits based on real losses whereas "guarantee" is protection with predetermined advantages regardless of the losses incurred.

The smart Trick of How To Find Out If Life Insurance Policy Exists That Nobody is Discussing

Term assurance provides life insurance coverage for a defined term. The policy does not build up cash worth. Term insurance is considerably less costly than a comparable long-term policy but will become greater with Take a look at the site here age. Policy holders can conserve to offer increased term premiums or reduce insurance requirements (by paying off debts or conserving to provide for survivor needs).

The face amount of the policy is always the quantity of the principal and interest impressive that are paid needs to michael goldstein hannah the candidate pass away before the final installment is paid. Group life insurance (likewise understood as wholesale life insurance coverage or institutional life insurance) is term insurance coverage covering a group of people, usually workers of a company, members of a union or association, or members of a pension or superannuation fund. how to find out if someone has life insurance.

Rather, the underwriter considers the size, turnover, and financial strength of the group. Contract provisions will try to omit the possibility of adverse choice. Group life insurance often enables members leaving the group to preserve their protection by purchasing specific coverage. The underwriting is carried out for the entire group instead of people.

The Best Strategy To Use For How To Sell Life Insurance Successfully

A permanent insurance coverage collects a money value up to its date of maturation. The owner can access the money in the money value by withdrawing money, borrowing the cash value, or giving up the policy and getting the surrender value. The three fundamental kinds of irreversible insurance are whole life, universal life, and endowment.

Universal life insurance coverage (ULl) is a fairly new insurance item, planned to integrate permanent insurance coverage with greater versatility in premium payments, along with the potential for higher development of money values. There are numerous kinds of universal life insurance coverage policies, including interest-sensitive (also understood as "conventional fixed universal life insurance"), variable universal life (VUL), ensured death benefit, and has equity-indexed universal life insurance coverage.

Paid-in premiums increase their cash values; administrative and other costs reduce their cash values. Universal life insurance coverage attends to the viewed downsides of whole lifenamely that premiums and death benefits are fixed. With universal life, both the premiums and survivor benefit are flexible. With the exception of guaranteed-death-benefit universal life policies, universal life policies trade their higher flexibility off for fewer warranties.

The Best Guide To How Much Life Insurance Should You Have

The survivor benefit can likewise be increased by the policy owner, generally needing brand-new underwriting (how does whole life insurance work). Another function of flexible death advantage is the capability to select option A or option B survivor benefit and to change those alternatives over the course of the life of the insured. Option A is frequently described as a "level death benefit"; death advantages remain level for the life of the guaranteed, and premiums are lower than policies with Choice B survivor benefit, which pay the policy's money valuei.e., a face quantity plus earnings/interest.

Excitement About How Much Life Insurance Do I Really Need

Table of ContentsHow Long Do You Have To Claim Life Insurance Can Be Fun For EveryoneA Biased View of What Is Whole Life Insurance PolicySome Known Details About Which Of These Life Insurance Riders Allows The Applicant To Have Excess Coverage? Getting My What Does Whole Life Insurance Mean To WorkNot known Facts About How Long Does It Take To Cash Out Life Insurance PolicyThe Best Guide To Where To Buy Life Insurance

This investigation and resulting examination is described underwriting. Health and way of life concerns are asked, with specific responses possibly meriting additional examination (what is group Take a look at the site here term life insurance). Particular factors that may be considered by underwriters include: Individual case history; Household case history; Driving record; https://angelofnaz529.skyrock.com/3337223550-About-What-Is-A-Corridor-In-Relation-To-A-Universal-Life-Insurance.html Height michael goldstein hannah and weight matrix, otherwise called BMI (Body Mass Index). Based on the above and extra elements, candidates will be positioned into one of a number of classes of health rankings which will figure out the premium paid in exchange for insurance at that specific provider.

As part of the application, the insurance company typically requires the candidate's consent to acquire info from their physicians. Automated Life Underwriting is a technology service which is developed to carry out all or a few of the screening functions typically completed by underwriters, and thus looks for to reduce the work effort, time and/or information needed to underwrite a life insurance application.

The death of underwritten individuals increases a lot more quickly than the basic population. At the end of ten years, the death of that 25-year-old, non-smoking male is 0.66/ 1000/year. Subsequently, in a group of one thousand 25-year-old males with a $100,000 policy, all of typical health, a life insurance coverage company would need to collect approximately $50 a year from each participant to cover the reasonably couple of expected claims.

Some Known Factual Statements About How Much Life Insurance Do You Need

A 10-year policy for a 25-year-old non-smoking male with favored case history might get offers as low as $90 annually for a $100,000 policy in the competitive US life insurance coverage market. Many of the earnings received by insurance provider consists of premiums, but profits from investing the premiums forms an essential source of profit for most life insurance coverage companies.

In the United States, life insurance companies are never lawfully required to offer protection to everyone, with the exception of Civil liberty Act compliance requirements. Insurance provider alone identify insurability, and some people are considered uninsurable. The policy can be decreased or rated (increasing the premium quantity to compensate for the greater danger), and the quantity of the premium will be proportional to the stated value of the policy.

These categories are chosen best, preferred, requirement, and tobacco. Preferred finest is booked only for the healthiest people in the general population. This might imply, that the proposed insured has no negative case history, is not under medication, and has no family history of early-onset cancer, diabetes, or other conditions.

Getting My What Is The Best Life Insurance Policy To Work

The majority of people remain in the standard category. Individuals in the tobacco category normally need to pay greater premiums due to the higher mortality. Recent United States mortality tables predict that approximately 0.35 in 1,000 non-smoking males aged 25 will pass away during the first year of a policy. Mortality around doubles for every extra 10 years of age, so the mortality rate in the very first year for non-smoking men is about 2.5 in 1,000 people at age 65.

Upon the insured's death, the insurance company needs appropriate evidence of death before it pays the claim. If the insured's death is suspicious and the policy amount is big, the insurer may examine the situations surrounding the death before deciding whether it has a commitment to pay the claim. Payment from the policy may be as a swelling amount or as an annuity, which is paid in regular installments for either a specific duration or for the recipient's lifetime.

In general, in jurisdictions where both terms are utilized, "insurance" refers to offering protection for an occasion that might occur (fire, theft, flood, etc.), while "guarantee" is the provision of protection for an event that is particular to happen. In the United States, both kinds of protection are called "insurance" for reasons of simpleness in business offering both items. [] By some meanings, "insurance coverage" is any coverage that identifies benefits based upon real losses whereas "assurance" is coverage with established advantages irrespective of the losses incurred.

Top Guidelines Of What Is A Universal Life Insurance Policy

Term guarantee supplies life insurance coverage for a defined term. The policy does not collect money worth. Term insurance is substantially less costly than an equivalent permanent policy however will become greater with age. Policy holders can save to offer for increased term premiums or decrease insurance coverage requirements (by settling financial obligations or conserving to attend to survivor needs).

The face quantity of the policy is constantly the amount of the principal and interest exceptional that are paid ought to the candidate pass away prior to the final installment is paid. Group life insurance (likewise understood as wholesale life insurance or institutional life insurance coverage) is term insurance covering a group of individuals, usually employees of a company, members of a union or association, or members of a pension or superannuation fund. how do life insurance companies make money.

Rather, the underwriter considers the size, turnover, and financial strength of the group. Agreement arrangements will attempt to exclude the possibility of unfavorable selection. Group life insurance coverage often enables members exiting the group to preserve their coverage by buying individual protection. The underwriting is performed for the entire group instead of people.

Fascination About How Much Is Life Insurance Per Month

A long-term insurance policy builds up a money value as much as its date of maturation. The owner can access the cash in the cash value by withdrawing cash, obtaining the cash value, or surrendering the policy and getting the surrender value. The 3 fundamental kinds of long-term insurance are whole life, universal life, and endowment.

Universal life insurance coverage (ULl) is a reasonably new insurance product, planned to integrate long-term insurance protection with greater flexibility in premium payments, in addition to the potential for greater development of money values. There are several types of universal life insurance policies, including interest-sensitive (likewise called "standard set universal life insurance"), variable universal life (VUL), guaranteed survivor benefit, and has equity-indexed universal life insurance coverage.

Paid-in premiums increase their cash values; administrative and other expenses minimize their cash worths. Universal life insurance deals with the perceived downsides of entire lifenamely that premiums and survivor benefit are repaired. With universal life, both the premiums and death benefit are versatile. With the exception of guaranteed-death-benefit universal life policies, universal life policies trade their higher versatility off for fewer guarantees.

The Best Strategy To Use For How Much Do Life Insurance Agents Make

The survivor benefit can likewise be increased by the policy owner, normally needing brand-new underwriting (how much term life insurance do i need). Another feature of versatile survivor benefit is the ability to choose alternative A or choice B survivor benefit and to alter those alternatives over the course of the life of the guaranteed. Option A is frequently referred to as a "level death benefit"; survivor benefit remain level for the life of the guaranteed, and premiums are lower than policies with Option B death benefits, which pay the policy's cash valuei.e., a face quantity plus earnings/interest.

What Does What Do You Need To Become An Insurance Agent Mean?

However ensure your policies are based on a realistic price quote of your requirements, and not simply on worry. If you have an enduring relationship with your representative, there's no reason to suspect that she or he is simply after your cash. A good representative will always suggest the very best items for you.

You're the one who needs to live with the insurance plan. If you suspect your insurance coverage representative has actually guided you towards a policy that's wrong for you, you do have option. Get in contact with your state's insurance coverage department though the National Association of Insurance Commissioners. Alice Holbrook is a personnel author covering insurance coverage and investing for.

Like an auto insurance coverage or health insurance coverage sales representative, a life insurance agent will get in touch with customers and stroll them through the procedure of getting and purchasing life insurance coverage. While some companies provide life insurance through an advantages package, it is likewise available for individual needs. An insurance representative can assist customers with the confusing procedure of completing insurance kinds.

All About What Is It Like Being An Insurance Agent

A life insurance coverage agent needs to be a terrific communicator and can equate a complex process with ease. It takes hands-on training and a state license to end up being a life insurance representative. A bachelor's degree is recommended, but not needed to begin. An insurer will usually train a brand-new hire, but continued education and courses are https://www.pinterest.com/wesleyfinancialgroup/ needed to satisfy state requirements for an insurance license and can be discovered in colleges and online.

Life insurance and medical insurance might require different licenses. As soon as hired, you will watch an experienced agent to acquire insight into the documents procedures and filing. To be an excellent life insurance representative, you need to have excellent people skills. Talking with clients on the topic of life insurance can be challenging.

Nevertheless, life insurance coverage can offer for member of the family in the future and offer a sense of comfort in the present. A good life insurance coverage agent comprehends this important requirement and can guide clients through any doubts and find the best policies that work for the clients' lifestyle and finances. There are many success stories for life insurance agents, and it is a good job for those seeking to assist others.

How How To Become A Shelter Insurance Agent can Save You Time, Stress, and Money.

Life insurance coverage representatives have task security too, as long as they can find and retain clients. If working for an insurance sales company, life insurance agents can make commissions in addition to their salaries. With this Life Insurance Representative task description sample, you can get a good concept of what employers are looking for when working with for this position.

Our insurance firm is searching for a Life Insurance coverage Representative to join our group. what does it take to be an insurance agent. Your task duties involve helping potential customers find the ideal insurance items to fit their requirements. You stroll consumers through the whole sign-up procedure, so you require familiarity with every aspect of acquiring life insurance coverage. Making cold calls and pursuing leads, both on the phone or in individual, are essential to developing our client base, so you need to have exceptional communication and client service skills.

Sales experience is a plus. Use cold calling and direct mail strategies to make salesHelp customers through the buying processAnswer any questions new or existing customers might haveDocument all of your salesMaintain your license through continuing educationA high school diploma or GED certificateAn insurance coverage sales license or determination to earn oneCommunication and sales skillsExperience in medical insurance or life insurance coverage sales (chosen).

How How To Choose An Insurance Agent can Save You Time, Stress, and Money.

A life insurance coverage agent is an individual whose expertise is in fitting customers with life insurance to suit their needs. These needs can range greatly, from earnings protection for loved ones in case of an untimely death to transferring assets effectively from an estate after death, and even to saving for retirement in a tax-efficient manner.

They might likewise be estate coordinators, trust consultants, and investment professionals. The objective of every life insurance coverage agent need to be to provide the very best suggestions possible to their clients about which life insurance coverage they must buy. A life insurance agent need to not try to "offer" someone on a policy. They must be more of a specialist, discovering as much as they can about a client's lifestyle and needs and fitting the proper policy to them.

Some have years of education and experience and work thoroughly utilizing life insurance to solve sophisticated requirements from clients. Other life insurance agents are little more than salespersons pushing the same product on every client, no matter expense or the requirements of the client. Some agents who offer life insurance coverage are comprehensive monetary organizers and utilize life insurance as one solution to suit the holistic financial preparation strategy.

Indicators on How To Become A Licensed Insurance Agent You Should Know

These designations demonstrate to clients of the agent that have achieved them a dedication to quality. Other representatives just sell life insurance coverage and utilize life insurance as a solution even when much better or more economical alternatives may be readily available. If you remain in the marketplace for a new life insurance agent you need to try to find an agent with a CLU designation, since this typically is a signal that the representative is professional and likewise most likely experienced in the industry.

Normally they are specialists in their business' items however understand little about any product offerings from outdoors companies. how to get license for insurance agent. When this holds true, there is a conflict between the representative and the customer. The client is relying on the representative to offer the very best advice and the best item to fit their requirements, but the agent only wishes to sell life insurance from their own company.

For some clients, this seems like fitting a square peg in a round hole. No one desires to waste cash by purchasing a similar item at a higher rate, however the greater the cost, the greater the commission to the agents. Not every agent works for one specific business, but to offer life insurance coverage from a company a representative does require to get approved.

The Main Principles Of How To Become An Insurance Agent In Pa

Independent representatives or those not tied to one private business are typically the best ones to deal with. Profession agents for one business can be a few of the most knowledgeable in the market though, and even they can generally draw on several business for term life insurance. Term life insurance is not typically the least expensive wes hall attorney nashville tn from the standard large companies who concentrate on entire life.

We are able to compare life insurance coverage prices estimate across providers, which lets you see prices for all comparable policies. This can save you countless dollars over the life time of the life insurance coverage policy, or allow you to leave more defense to your enjoyed ones and beneficiaries for a comparable expense.

Even if you already deal with a monetary consultant, comparing quotes on Life Ant will assist you comprehend if you are being priced estimate reasonable rates from your advisor - how to become an insurance agent. We do not supply particular financial recommendations, however our company believe the more notified our clients are, the better they will be with their monetary preparation.

See This Report on How To Become A Nationwide Insurance Agent

But make sure your policies are based on a reasonable estimate of your requirements, and not simply on worry. If you have a long-standing relationship with your representative, there's no factor to believe that she or he is simply after your money. An excellent representative will always advise the best items for you.

You're the one who needs to live with the insurance plan. If you presume your insurance coverage agent has steered you toward a policy that's not right for you, you do have recourse. Get in contact with your state's insurance coverage department though the National Association of Insurance Coverage Commissioners. Alice Holbrook is a staff author covering insurance and investing for.

Like an auto insurance coverage or health insurance coverage sales representative, a life insurance coverage agent will contact clients and walk them through the procedure of requesting and acquiring life insurance protection. While some companies offer life insurance through a benefits package, it is also readily available for private requirements. An insurance coverage representative can assist customers with the confusing procedure of submitting insurance forms.

Indicators on How To Become An Insurance Agent In Colorado You Need To Know

A life insurance coverage representative has to be an excellent communicator and can equate a complex process with ease. It takes hands-on training and a state license to become a life insurance agent. A bachelor's degree is advised, but not needed to begin. An insurance provider will normally train a new hire, but continued education and courses are needed to satisfy state requirements for an insurance coverage license and can be discovered in colleges and online.

Life insurance and health insurance may require different licenses. As soon as worked with, you will watch a knowledgeable representative to get insight into the documents processes and filing. To be an excellent life insurance coverage agent, you should have excellent individuals skills. Talking with customers on the subject of life insurance coverage can be tricky.

Nevertheless, life insurance coverage can offer member of the family in the future and offer a sense of convenience in the present. An excellent life insurance representative comprehends this essential requirement and can direct clients through any doubts and discover the ideal policies that work for the customers' way of life and finances. There are many success stories for life insurance coverage representatives, and it is an excellent task for those wanting to help others.

Rumored Buzz on How Do You Become A Insurance Agent

Life insurance representatives have job security also, as long as they can find and keep clients. If working for an insurance sales company, life insurance representatives can make commissions in addition to their incomes. With this Life Insurance Agent job description sample, you can get a good concept of what companies are searching for when employing for this position.

Our insurance firm is trying to find a Life Insurance Representative to join our group. how to become an independent insurance agent in texas. Your task responsibilities include assisting potential consumers find the ideal insurance products to fit their requirements. You stroll customers through the entire sign-up process, so you need familiarity with every aspect of acquiring life insurance coverage. Making cold calls and pursuing leads, both on the phone or face to face, are vital to building our client base, so you need to have exceptional communication and customer support abilities.

Sales experience is a plus. Use cold calling and direct-mail advertising methods to make salesHelp customers through the buying processAnswer any concerns new or existing clients might haveDocument all of your salesMaintain your license through continuing educationA high Website link school diploma or GED certificateAn insurance sales license or desire to earn oneCommunication and sales skillsExperience in medical insurance or life insurance coverage sales (preferred).

Why Choose An Independent Insurance Agent Can Be Fun For Everyone

A life insurance coverage agent is a person whose expertise remains in fitting clients with life insurance coverage to suit their requirements. These requirements can vary significantly, from income defense for enjoyed ones in the occasion of an untimely death to moving assets effectively from an estate after death, and even to conserving for retirement in a tax-efficient manner.

They may likewise be estate coordinators, trust advisers, and investment experts. The goal of every life insurance coverage representative ought to be to supply the finest recommendations possible to their customers about which life insurance they should purchase. A life insurance coverage representative should not attempt to "offer" somebody on a policy. They ought to be more of a specialist, discovering as much as they can about a customer's lifestyle and requirements and fitting the suitable policy to them.

Some have years of education and experience and work extensively using life insurance coverage to fix sophisticated requirements from customers. Other life insurance agents are little bit more than salespersons pushing the same item on every client, despite expense or the needs of the customer. Some representatives who sell life insurance coverage are detailed financial coordinators and utilize life insurance coverage as one service to fit into the holistic monetary planning technique.

Some Known Facts About How To Become A Farm Bureau Insurance Agent.

These classifications show to clients of the agent that have actually attained them a dedication to excellence. Discover more Other representatives only sell life insurance coverage and use life insurance as a solution even when better or cheaper choices might be available. If you remain in the market for a new life insurance coverage representative you must search for a representative with a CLU designation, because this usually is a signal that the representative is expert and also probably experienced in the market.

Generally they are professionals in their business' items however know little about any product offerings from outside companies. how much does a property and casualty insurance agent make. When this is the case, there is a dispute in between the representative and the customer. The customer is trusting the agent to supply the best recommendations and the finest product to fit their requirements, however the agent only desires to offer life insurance coverage from their own firm.

For some clients, this feels like fitting a square peg in a round hole. Nobody wants to squander money by buying an equivalent product at a higher rate, however the higher the price, the higher the commission to the agents. Not every agent works for one specific business, however to sell life insurance coverage from a company an agent does need to get authorized.

The Only Guide to How To Become A Certified Insurance Agent

Independent agents or those not tied to one private company are normally the very best ones to work with. Career representatives for one company can be some of the most experienced in the market though, and even they can usually draw on numerous companies for term life insurance coverage. Term life sell my timeshare without upfront fees insurance coverage is not usually the least costly from the standard large business who focus on entire life.

We are able to compare life insurance coverage prices estimate throughout providers, which lets you see prices for all similar policies. This can conserve you countless dollars over the life time of the life insurance coverage policy, or allow you to leave more defense to your enjoyed ones and heirs for a similar cost.

Even if you currently work with a monetary adviser, comparing quotes on Life Ant will help you understand if you are being quoted reasonable prices from your adviser - what is an insurance agent. We do not supply specific financial suggestions, however our company believe the more notified our clients are, the happier they will be with their financial planning.

All about How Much Does A Crop Insurance Agent Make

However make certain your policies are based upon a realistic estimate of your requirements, and not just on fear. If you have a long-standing relationship with your agent, there's no reason to think that she or he is simply after your cash. An excellent agent will always advise the finest products for you.

You're the one who needs to live with the insurance coverage policy. If you presume your insurance coverage representative has actually steered you toward a policy that's not right for you, you do have recourse. Get in contact with your state's insurance department though the National Association of Insurance Commissioners. Alice Holbrook is a staff author covering insurance coverage and investing for.

Like an auto insurance or health insurance salesperson, a life insurance coverage agent will call customers and stroll them through the procedure of looking for and purchasing life insurance protection. While some companies provide life insurance coverage through a benefits package, it is also offered for private needs. An insurance representative can help clients with the complicated process of completing insurance coverage forms.

The Greatest Guide To How Much Does The Average Insurance Agent Make

A life insurance agent needs to be a fantastic communicator and can equate a complex procedure with ease. It takes hands-on training and a state license to become a life insurance agent. A bachelor's degree is advised, however not required to begin. An insurance coverage business will generally train a brand-new hire, but continued education and courses are required to fulfill state requirements for an insurance license and can be discovered in colleges and online.

Life insurance coverage and medical insurance may need different licenses. As soon as hired, you will watch a knowledgeable representative to gain insight into the paperwork procedures and filing. To be an excellent life insurance coverage agent, you should have exceptional individuals skills. Talking with clients on the topic of life insurance coverage can be challenging.

Nevertheless, life insurance coverage can offer member of the family in the future and provide a sense of comfort in today. A great life insurance coverage representative understands this important need and can direct customers through any doubts and discover the best policies that work for the clients' lifestyle and finances. There are numerous success stories for life insurance representatives, and it is a good job for those aiming to assist others.

About How Much Does A Insurance Agent Make

Life insurance agents have task security too, as long as they can discover and keep customers. If working for an insurance coverage sales agency, life insurance agents can make commissions in addition to their wages. With this Life Insurance coverage Representative task description sample, you can get a good concept of what employers are looking for when working with for this position.

Our insurance coverage firm is trying to find a Life Insurance coverage Representative to join our group. how to be a successful insurance agent. Your job tasks include assisting prospective clients discover the ideal insurance items to fit their needs. You stroll customers through the whole sign-up process, so you require familiarity with every aspect of buying life insurance coverage. Making cold calls and pursuing leads, both on the phone or face to face, are vital to constructing our customer base, so you need to have excellent communication and customer support abilities.

Sales experience is a plus. Use cold calling and direct mail strategies to make salesHelp customers through the acquiring processAnswer any questions new or existing customers might haveDocument all of your salesMaintain your license through continuing educationA high school diploma or GED certificateAn insurance sales license or willingness to make oneCommunication and sales skillsExperience in medical insurance or life insurance sales (chosen).

About What Do The Letters Clu Stand For In Relation To An Insurance Agent?

A life insurance agent is a person whose competence remains in fitting clients with life insurance to suit their needs. These requirements can vary greatly, from income defense for enjoyed ones in case of an unforeseen demise to moving assets effectively from an estate after death, and even to saving for retirement in a tax-efficient way.

They may also be estate planners, trust advisers, and financial investment professionals. The goal of every life insurance coverage representative ought to be to supply the very best recommendations possible to their customers about which life insurance coverage they should purchase. A life insurance coverage agent need to not attempt to "sell" someone on a policy. They need to be more of a consultant, learning as much as they can about a client's lifestyle and needs and fitting the proper policy to them.

Some have years of Discover more education and experience and work thoroughly using life insurance to solve sophisticated needs from clients. Other life insurance agents are bit more than salespersons pressing the exact same product on every client, despite cost or the needs of the client. Some agents who sell life insurance coverage are thorough financial organizers and utilize life insurance as one solution to suit the holistic monetary preparation technique.

Little Known Facts About How To Become Independent Insurance Agent.

These classifications demonstrate to clients of the representative that have sell my timeshare without upfront fees actually attained them a commitment to quality. Other agents just sell life insurance coverage and use life insurance as a service even when much better or cheaper options may be readily available. If you remain in the marketplace for a new life insurance representative you must look for a representative with a CLU classification, since this generally is a signal that the representative is expert and also probably experienced in the industry.

Typically they are specialists in their business' items but understand little about any product offerings from outdoors firms. how much does it cost to become a licensed insurance agent. When this is the case, there is a dispute between the agent and the client. The client is relying on the representative to supply the very best recommendations and the finest product to fit their needs, however the agent only wants to offer life insurance coverage from their own company.

For some clients, this feels like fitting a square peg in a round hole. Nobody wants to lose cash by buying an equivalent product at a higher cost, however the higher the rate, the greater the commission to the representatives. Not every representative works for one particular company, but to offer life insurance from a company a representative does need to get approved.

A Biased View of How To Find An Independent Insurance Agent

Independent representatives or those not connected to one individual business are usually the very best ones to work with. Profession agents for one company can be a few of the most knowledgeable in the industry though, and even they can normally make use of multiple business for term life insurance. Term life insurance coverage is not usually the least costly from the traditional big business who specialize in entire life.

We have the ability to compare life insurance coverage prices estimate across companies, which lets you see costs for all similar policies. This can conserve you countless dollars over the life time of the life insurance coverage policy, or enable you to leave more protection to your enjoyed ones Website link and heirs for a similar cost.

Even if you already work with a monetary consultant, comparing quotes on Life Ant will assist you understand if you are being priced estimate fair rates from your advisor - how to become an auto insurance agent. We do not supply specific monetary guidance, but our company believe the more informed our clients are, the better they will be with their monetary preparation.

Get This Report on How To Be The Best Insurance Agent

More junior agents can frequently advance in making prospective and obligation if they prefer to do so, as they gain more experience in the industry. But the important thing to keep in mind about being a life insurance representative is this: When you're a life insurance coverage representative, you're not just selling a product. In later years, the representative may receive anywhere from 3-10% of each year's premium, likewise referred to as "renewals" or "tracking commissions." Let's take a look at an example: Bob the insurance coverage agent offers Sally a entire life insurance policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 per month or $1,200 each year. Thus, in the very first year, Bob will make a $1,080 commission on offering this life insurance policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As mentioned previously, a life insurance coverage representative is not a profession for the thin-skinned or faint of heart. In fact, more than any other element, consisting of education and experience, life insurance coverage agents should have a fighting spirit. They need to be individuals who love the adventure of the hunt, the rush of a sale, and see rejection as a stepping stone to eventual success.

The huge majority of life insurance coverage business have no official education requirements for becoming an agent. While numerous prefer college graduates, this basic rule is continuously neglected in favor of the "right" prospects. Previous experience in the insurance coverage industry is not needed because most medium and big insurance coverage carriers have internal programs to train their salesmen about the items they're going to offer.

Insurance agents are currently accredited by the private state or states in which they'll be selling insurance coverage. This usually needs passing a state-administered licensing test in addition to taking a licensing class that typically runs 25-50 hours. The sales commission life insurance representatives may make in the very first year if they are on a commission-only wage; that's the greatest commission for any type of insurance coverage.

First and foremost, you'll need to create a resume that highlights your entrepreneurial spirit. how to become a licensed health insurance agent. You'll desire to include anything that shows you taking initiative to make things happen, whether it was starting your own business or taking another person's company to the next level. Life insurance coverage representatives have actually to be driven and have the capability to be self-starters.

Getting The How Much Does The Average Insurance Agent Make To Work

As soon as you have actually got your resume polished, you'll wish to start discovering positions and using. It's actually important you do not feel forced to take the very first position that occurs, as working for the incorrect business can both burn you out and haunt you for the rest of your insurance profession.

Possibly the best place to start in choosing where to use is to visit the insurance coverage business score sites for A.M. Finest, Moody's, or Standard & Poor's. From there, you'll have the ability to build a list of companies that have ratings of "A" or higher in your state. These business will normally use the most-secure products at reasonable rates, with an emphasis on compensating and keeping quality agents.

As soon as you have actually produced this list, begin taking a look at each company. Due to the high turnover rate of insurance representatives, the majority of companies plainly publish their task listings by geographical location, which makes them quickly searchable for you. When you discover a company in your area that appears to fit your personality, get the position as the company advises on its website.

Many insurer recruiters won't even speak with a prospective agent who doesn't first make a follow-up call, because this is a strong indication of a possible representative's persistence. Throughout your interview, continue to interact your entrepreneurial and "never ever say stop" personality, due to the fact that most supervisors will work with somebody based on these aspects over all the others integrated.

Your sales manager will be the first to remind you that your only purpose in life is to discover prospective clients. In fact, they'll be far more thinking about the number of contacts you're making each week than how well you understand their line of product. Do anticipate to struggle financially for the very first couple of months until your very first sales commissions start rolling in.

Numerous representatives are now fortunate to be compensated for one to two months of training before being placed on a "commission-only" basis. While the life insurance market pledges great rewards for those who want to strive http://codynzig541.lowescouponn.com/the-definitive-guide-to-how-to-become-an-insurance-agent-in-nc and put up with a great quantity of rejection, there are two other risks you need to be knowledgeable about.

How To Become An Insurance Agent In Michigan Things To Know Before You Get This

While that might be appealing and look like a terrific concept to get you began, it can likewise burn a lot of bridges with individuals you care about. Second, you need to visit your state insurance coverage commissioner's website and take a look at the complaint history against business that you're considering working for.

Accepting a job with the incorrect insurer will go a long method towards burning you out and destroying your imagine an appealing profession. If a career in life insurance coverage sales is something you really desire, take your time and await the right chance at the best business.

Insurance coverage is too intricate. I'm not certified. It's Have a peek at this website far too late to change careers. If you've ever considered the actions to becoming an insurance representative, you've likely been exposed to these common misunderstandings and misunderstandings about selling insurance coverage. To set the record straight, Farm Bureau Financial Providers is here to bust the top misconceptions about ending up being an insurance coverage representative and help make sure nothing stands between you and your dream opportunity! The fact is, the majority of our agents do not have a background in insurance coverage sales.

Though many of our leading candidates have some previous experience in sales, company and/or marketing, specific personality type, such as having an entrepreneurial spirit, self-motivation and the ability to interact effectively, can lay the right foundation for success in becoming an insurance coverage representative. From here, we equip our representatives with focused training, continuing education opportunities and individually mentorship programs designed to help them learn the ins and outs of the market.

Farm Bureau agents find their career path to be satisfying and rewarding as they help people and households within their community protect their livelihoods and futures. They understand that their organization is not simply about insurance items - it's about individuals, relationships and making entire communities healthier, safer and more safe.

Our employee are trained on our sales process which will help them identify the best coverage for each client/member or organization. The Farm Bureau sales procedure begins with recognizing a prospect, whether you're offering a personal policy or a business policy. From there, you can learn more about the potential client/member, find their needs and determine their long-lasting objectives.

Some Known Questions About How To Become A Insurance Agent.

More junior representatives can typically progress in earning possible and responsibility if they want to do so, as they gain more experience in the industry. But the crucial thing to keep in mind about being a life insurance representative is this: When you're a life insurance representative, you're not simply offering a product. In later years, the agent might get anywhere from 3-10% of each year's premium, also referred to as "renewals" or "trailing commissions." Let's take a look at an example: Bob the insurance coverage representative offers Sally a entire life insurance policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 each month or $1,200 per year. Hence, in the very first year, Bob will make a $1,080 commission on selling this life insurance coverage policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As pointed out previously, a life insurance representative is not an occupation for the thin-skinned or faint of heart. In reality, more than any other factor, including education and experience, life insurance coverage representatives need to have a battling spirit. They should be individuals who love the adventure of the hunt, the rush of a sale, and see rejection as a stepping stone to ultimate success.

The huge majority of life insurance business have no official education requirements for becoming a representative. While many prefer college graduates, this basic guideline is constantly overlooked in favor of the "right" prospects. Previous experience in the insurance coverage market is not needed because many medium and large insurance coverage providers have internal programs to train their salespeople about the items they're going to offer.

Insurance coverage representatives are presently licensed by the specific state or states in which they'll be offering insurance coverage. This usually requires passing a state-administered licensing test along with taking a licensing class that normally runs 25-50 hours. The sales commission life insurance representatives may earn in the very first year if they are on a commission-only wage; that's the greatest commission for any type of insurance coverage.

Most importantly, you'll need to create a resume that highlights your entrepreneurial spirit. how to become a licensed insurance agent. You'll wish to include anything that reveals you taking initiative to make things happen, whether it was beginning your own company or taking somebody else's organization to the next level. Life insurance coverage agents have actually to be driven and have the ability to be http://codynzig541.lowescouponn.com/the-definitive-guide-to-how-to-become-an-insurance-agent-in-nc self-starters.

Unknown Facts About What Do I Need To Become A Insurance Agent

When you have actually got your resume polished, you'll desire to start finding positions and applying. It's truly crucial you do not feel pressured to take the first position that comes along, as working for the incorrect company can both burn you out and haunt you for the rest of your insurance coverage career.

Possibly the best location to start in deciding where to apply is to go to the insurer rating websites for A.M. Finest, Moody's, or Standard & Poor's. From there, you'll have the ability to build a list of business that have rankings of "A" or greater in your state. These companies will typically use the most-secure items at reasonable prices, with a focus on compensating and keeping quality representatives.

Once you have actually produced this list, start taking a look at each company. Due to the high turnover rate of insurance representatives, the majority of business plainly publish their job listings by geographical area, which makes them easily searchable for you. When you find a company in your location that appears to fit your personality, request the position as the business advises on its site.

Lots of insurance provider employers won't even speak with a possible agent who does not very first make a follow-up call, because this is a strong sign of a possible representative's persistence. During your interview, continue to communicate your entrepreneurial and "never say stop" personality, due to the fact that the majority of managers will work with someone based on these elements over all the others integrated.

Your sales manager will be the very first to advise you that your only function in life is to discover prospective clients. In truth, they'll be far more thinking about the number of contacts you're making weekly than how well you know their product line. Do anticipate to have a hard time financially for the first few months till your very first sales commissions start rolling in.

Numerous representatives are now fortunate to be compensated for one to two months of training prior to being placed on a "commission-only" basis. While the life insurance industry guarantees terrific rewards for those who want to work hard and tolerate a great quantity of rejection, there are two other risks you require to be mindful of.

Rumored Buzz on How To Be A Successful Insurance Agent

While that might be tempting and look like a great concept to get you began, it can also burn a great deal of bridges with people you appreciate. Second, you need to visit your state insurance commissioner's site and check out the grievance history against companies that you're thinking about working for.

Accepting a task with the incorrect insurance business will go a long way towards burning you out and destroying your dreams of a promising career. If a career in life insurance coverage sales is something you really desire, take your time and wait on the best opportunity at the best company.

Insurance coverage is too intricate. I'm not certified. It's far too late to change careers. If you've ever thought about the steps to becoming an insurance agent, you have actually likely been exposed to these common misunderstandings and mistaken beliefs about selling insurance. To set the record directly, Farm Bureau Financial Solutions is here to bust the top myths about becoming an insurance representative and help guarantee nothing stands in between you and your dream opportunity! The fact is, the majority of our agents don't have a background in insurance sales.

Though numerous of our leading candidates have some previous experience in sales, business and/or marketing, certain personality characteristics, such as having an entrepreneurial spirit, self-motivation and the ability to interact efficiently, can lay the right foundation for success in becoming an insurance coverage agent. From here, we equip our representatives with concentrated training, continuing education chances and individually mentorship programs created to help them learn the ins and outs of the industry.

Farm Have a peek at this website Bureau representatives discover their career path to be satisfying and rewarding as they assist people and households within their community protect their livelihoods and futures. They comprehend that their organization is not simply about insurance coverage products - it has to do with people, relationships and making entire communities healthier, safer and more protected.

Our employee are trained on our sales procedure which will help them identify the best protection for each client/member or company. The Farm Bureau sales procedure begins with determining a possibility, whether you're selling a personal policy or a commercial policy. From there, you can be familiar with the possible client/member, find their needs and identify their long-term goals.

The 2-Minute Rule for How Can I Become An Insurance Agent

By this I mean, if you allow the customers to tell you what they require and what they're doing and follow their orders, this isn't for you. As an Insurance Representative, it's your job to inform customers, "paint the image" by giving reality examples, evaluate each person's circumstance and make suggestions that are in the finest interest of the client. offer policies that protect people and services from financial loss arising from car mishaps, fire, theft, and other occasions that can damage residential or commercial property. For organizations, property and casualty insurance coverage likewise covers employees' settlement claims, item liability claims, or medical malpractice claims. concentrate on offering policies that pay beneficiaries when a policyholder passes away.

offer policies that cover the costs of medical care and assisted-living services for seniors. They likewise may sell oral insurance coverage and short-term and long-lasting disability insurance coverage. Agents might concentrate on selling any among these items or function as generalists providing several items. An increasing number of insurance sales agents offer their clientsespecially those approaching retirementcomprehensive financial-planning services, consisting of retirement preparation and estate preparation.

This practice is most common with life insurance coverage representatives who already sell annuities, however numerous home and casualty representatives likewise sell financial products. how to become an insurance agent in ga. Many agents spend a great deal of time marketing their services and producing their own base of clients. They do this in a range of ways, including making "cold" sales contacts us to people who are not current clients.

Clients can either purchase a policy directly from the business's site or call the business to speak to a sales agent. Insurance representatives also discover brand-new customers through referrals by existing customers. Keeping customers pleased so that they advise the representative to others is a crucial to success for insurance coverage sales agents.

are insurance sales representatives who work specifically for one insurance coverage company. They can just sell policies offered by the company that uses them. work for insurance coverage brokerages, selling the policies of several business. They match insurance coverage policies for their clients with the company that provides the finest rate and protection.

The Main Principles Of Why Use An Independent Insurance Agent

$ 20,000 - $33,99911% of jobs $34,000 - $47,99912% of jobs $50,000 is the 25th percentile. Incomes listed below this are outliers.$ 48,000 - $61,99917% of jobs $62,000 - $75,99917% of tasks The typical salary is $79,730 a year$ 76,000 - $89,99913% of tasks $99,500 is the 75th percentile. Incomes above this are outliers.$ 90,000 - $103,99915% of tasks $104,000 - $117,9993% of tasks $118,000 - $131,9994% of tasks $132,000 - $145,9990% of tasks $146,000 - $159,9992% of jobs $160,000 - $174,0000% of jobs.

In many cases, life insurance coverage agents won't charge you anything if you deal with them to buy life insurance. So how do they get paid? Most representatives earn a percentage of the premiums on life insurance policies they sella instead of a set salary. That commission, nevertheless, does not come at an extra cost to you since Insurance coverage costs are regulated sellmy timeshare by each state's department of insurance.